大商所黄大豆系列期货及期权品种即将面向境外交易者开放

12月9日,证监会确定大连商品交易所的黄大豆1号、黄大豆2号、豆粕、豆油期货和期权为境内特定品种。上述品种于2022年12月26日引入境外交易者参与交易。

12月2日,郑商所发布公告,就菜籽油、菜籽粕、花生仁期货及期权引入境外交易者相关业务规则修改公开征求意见,具体时间待证监会确定。

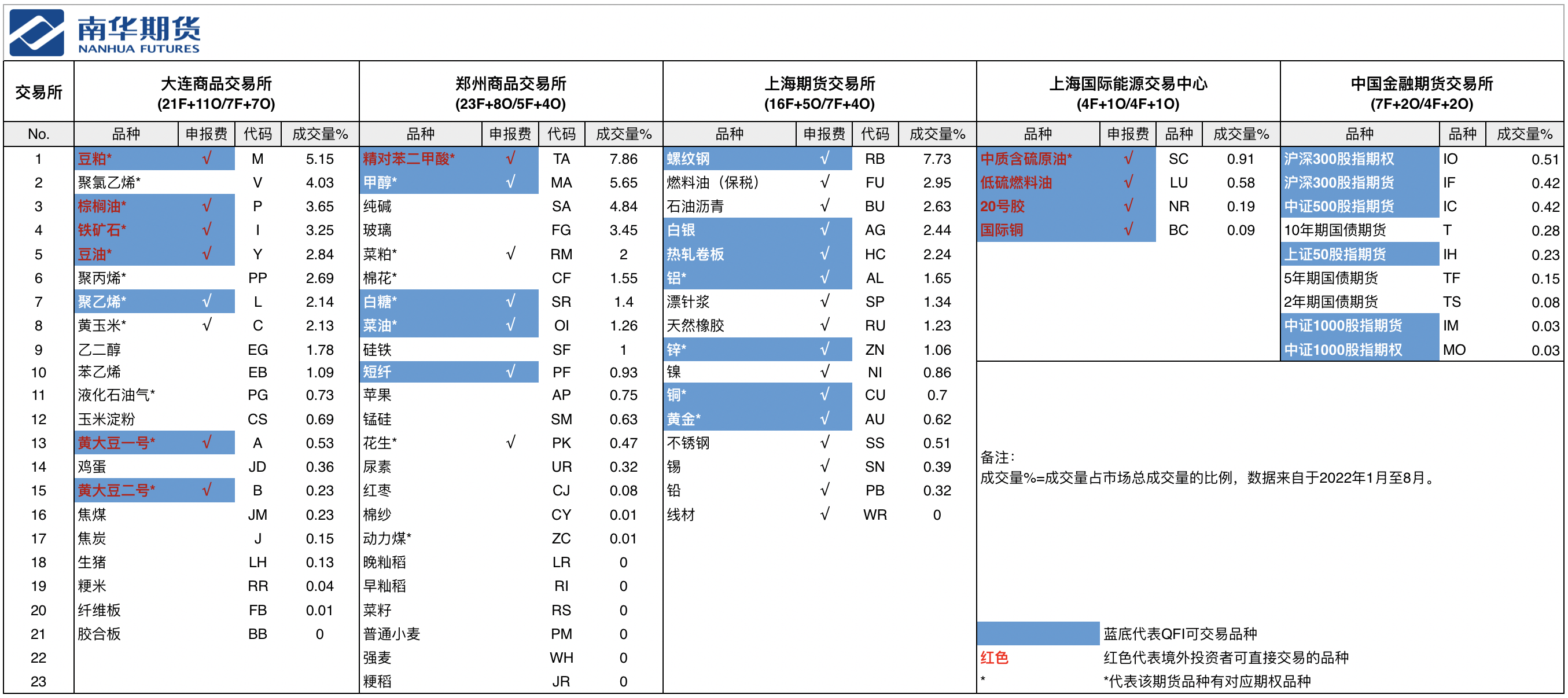

这意味着我国衍生品市场将迎来进一步国际化。截至目前,境外交易者能直接参与交易的有7个期货品种,2个期权品种。此次郑商所相关细则落地后,境外交易者能直接参与交易的品种将扩大到14个期货品种、9个期权品种。目前境外投资者参与中国衍生品交易的路径,除国际化品种路径外,仍可通过QFI路径参与。两种方式可交易标的对比详见下图。

The opening-up of DCE's soybean related futures/options products

On Nov. 30, Dalian Commodity Exchange issued an announcement requesting public opinions on the amendments to the relevant business rules on the opening-up of No. 1 soybean, No. 2 soybean, soybean meal, soybean oil futures, and options. On December 9, the CSRC determined that the Dalian Commodity Exchange's soybean 1, soybean 2, soybean meal, and soybean oil futures and options are internationalized futures products. These products will be available for overseas investors and overseas intermediaries to trade on December 26, 2022.

On Dec.2, Zhengzhou Commodity Exchange issued an announcement requesting public opinions on the amendments to the relevant business rules for the opening-up of rapeseed oil, rapeseed meal, peanut kernel futures, and options.

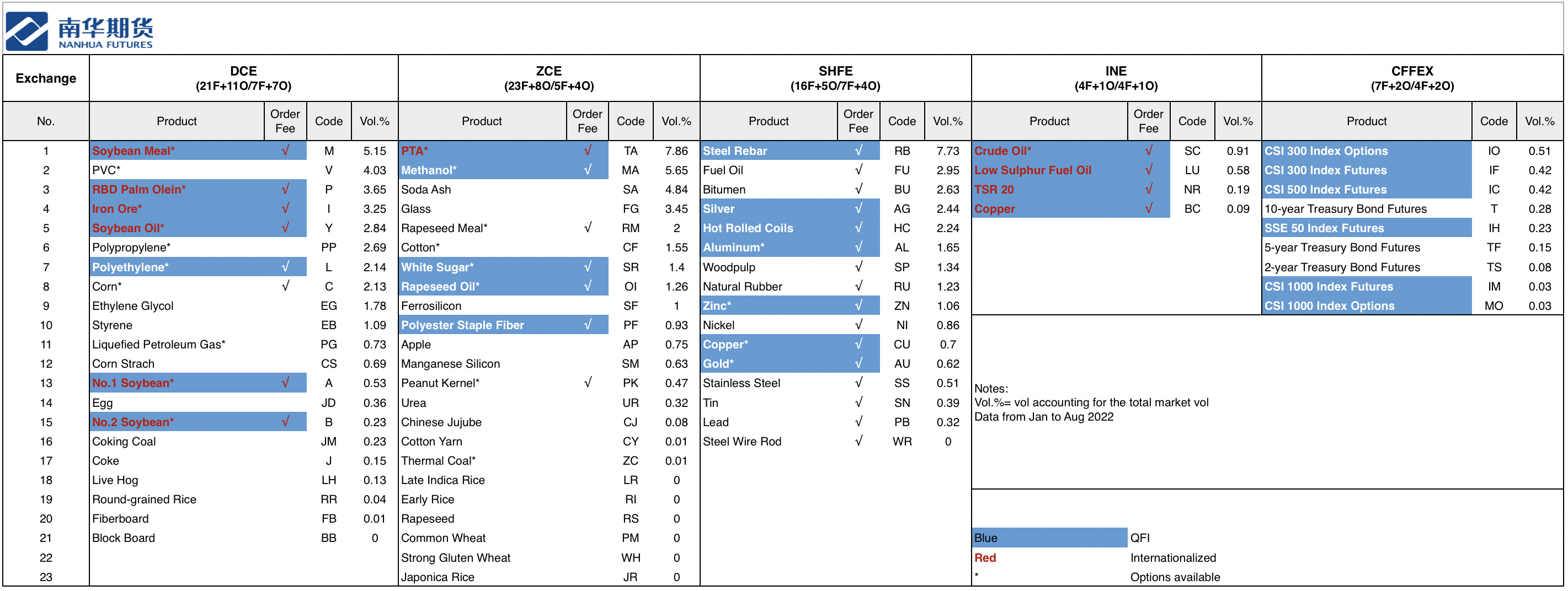

This means that China's derivatives market will see further internationalization. As of now, overseas traders can directly participate in the trading of 7 futures varieties and 2 options varieties. After the implementation of the relevant regulations of the Dalian Commodity Exchange and Zhengzhou Commodity Exchange, the number of varieties in which overseas traders can directly participate in trading will be expanded to 14 futures varieties and 9 options varieties.

The current two approaches for foreign investors to participate in China derivatives trading are via internationalized contracts and via QFI. See the chart below for a comparison of the underlying tradable products between the two approaches.

在此背景下,南华期货特别推出“喜迎大豆期货国际化:中国“大豆产业”期现联合” 线上研讨会,届时将与大连商品交易所、中国银行、九三集团的讲师围绕产品交易规则、宏观环境、压榨套利交易策略、汇率保值、跨境衍生品综合服务等话题进行深入交流,希望能更好地运用大豆衍生品工具,为境内外大豆产业客户提供期现一站式解决方案。

南华期货是最早服务于境外中介、QFI、境外投资者参与中国期货市场的期货公司之一,拥有丰富的境外机构服务经验。在中国大陆、中国香港、伦敦、芝加哥和新加坡均有设立分支机构,拥有期货、证券、外汇、资管全牌照,配合强大的研发支持、超前的技术软硬件支持,重点服务产业客户、机构客户,为客户提供定制化交易方案、资产配置、研发支持等一站式综合解决方案。专业的服务团队,秉承专业、专注、高效、创新的精神,不断深耕细作,致力于为每一位客户提供最优质金融服务。

In this context, Nanhua Futures has launched the webinar "Welcoming Soybean Futures Internationalization: Combining Futures and Spot in China's Soybean Industry", in which lecturers from Dalian Commodity Exchange, Bank of China and Jiusan Group will have in-depth discussion on topics such as product trading rules, macroeconomics, arbitrage trading strategies, exchange rates and cross-border derivatives integrated services, hoping to better utilize soybean derivatives instruments and provide one-stop solutions for domestic and foreign soybean industry clients.

Nanhua Futures is one of the earliest futures companies serving foreign intermediaries, QFIs and foreign investors participating in the China futures market, with rich experience in serving foreign institutions. With branches in mainland China, Hong Kong, China, London, Chicago and Singapore, and full licenses in futures, securities, foreign exchange and capital management, together with strong R&D support and advanced technical hardware and software support, we focus on serving industrial clients and institutional clients, providing one-stop comprehensive solutions such as customized trading solutions, asset allocation and R&D support. The professional service team, adhering to the spirit of professionalism, focus, efficiency and innovation, continues to work deeply and is committed to providing the best quality financial services for each customer.

郑州商品交易所关于就菜籽油、菜籽粕、花生仁期货及期权引入境外交易者相关业务规则修改公开征求意见的公告:http://www.czce.com.cn/cn/gyjys/jysdt/ggytz/webinfo/2022/12/1655829591131535.htm

证监会确定黄大豆1号、黄大豆2号、豆粕、豆油期货和期权为境内特定品种:

http://www.dce.com.cn/dalianshangpin/xwzx93/jysxw/8524655/index.html

ZCE Announcement on Requesting Public Opinions on the Amendments to the Relevant Business Rules for the Opening-up of Rapeseed Oil, Rapeseed Meal, Peanut Kernel Futures and Options:

english.czce.com.cn/enportal/News/Announcements/webinfo/2022/12/1655829591425039.htm

DCE Announcement on Requesting Public Opinions on the Amendments to the Relevant Business Rules on the Opening-up of No. 1 Soybean, No. 2 Soybean, Soybean Meal, Soybean Oil Futures and Options:

http://www.dce.com.cn/DCE/tradingclearing/Exchange%20Notice/8522716/index.html